This week’s federal budget heralded positive news for continued investments in infrastructure projects across the country after announcing a $24.5 billion package.

As reported, the Turnbull government announced its 10-year infrastructure plan of $75 billion including the $24.5 billion for new projects.

The package is a welcome injection, but when analysing previous budgets and forward estimates the whole story isn’t being told.

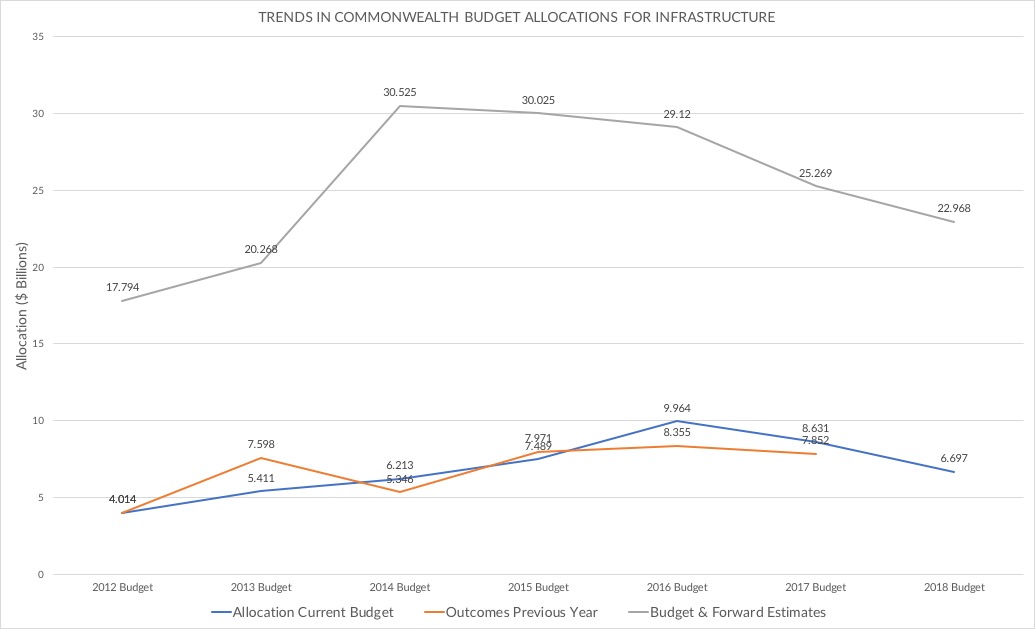

While this week’s budget showcases a big investment, data shows the trajectory in allocations of cash for infrastructure projects actually has gone down in the long-term.

In a recent analysis, we can see that allocation for the budget and forward estimates is declining (grey line) and continues its downward trend.

The graph also shows the trajectory of actual allocation in infrastructure for the financial year (blue line) and if the money was actually spent in the previous year (orange line).

This data is the clearest indication of the government’s continued approach to support infrastructure projects through “equity investments, concessional loans and guarantees”.

The trend has been observed in the past 5-6 years as the federal government plays an active strategy in not allocating state governments direct cash to fund infrastructure and instead give seed money to corporations for projects.

As a recent Australian Financial Review article points out recent equity investments by the Commonwealth include “$9 billion for the Melbourne to Brisbane inland rail, $5.3 billion for the second Sydney airport and possibly the $5 billion Melbourne Airport rail link”.

“It allows projects to be taken off-budget but they also need to deliver a commercial return or they will end up back on the budget bottom line.”

Engineers Australia National Manager of Policy Jonathan Russell says analysing federal budgets this way ensures full scrutiny of how government spending money on projects is fully allocated.

“Looking at previous allocations in the budget and looking at them now, we would be hasty in saying that the government is walking away from its infrastructure investments,” he said.

“So we have to take into account the government’s strategy to take more and more of an equity approach when investing in infrastructure.

“And this approach doesn’t look like to be going away anytime soon, as recent equity investments in the inland rail and the new Sydney airport is anything to go by.”

Mr Russell says EA is supportive of the tactic, but would like government to be more transparent in its budget line.

“We urge the government to establish just exactly how much money is being poured into the private sector and what projects are forthcoming so we can fully understand off-budget projects in the future.”